With the economy seeing more freelancers and small businesses than ever, many groups and individuals are having to start making decisions on financial handling.

While before, one could simply deal in cash or checks, the large movement to e-commerce and online transactions have made the business-to-consumer exchange confusing for those running their own business.

Thankfully, entrepreneurs have seen this cry for help and rolled out solutions which make taking card payments a breeze. Stripe and Square are easily the two most talked about.

With the two in a heated competition and sharing many similarities, it leaves many at a loss for which company to go with.

However, when we dig deeper into the two companies, it becomes apparent that each service is designed to suit a specific niche.

We will be looking at the platform differences in this article and help you decide which payment gateway will be the best solution for your business needs.

What is a Payment Gateway?

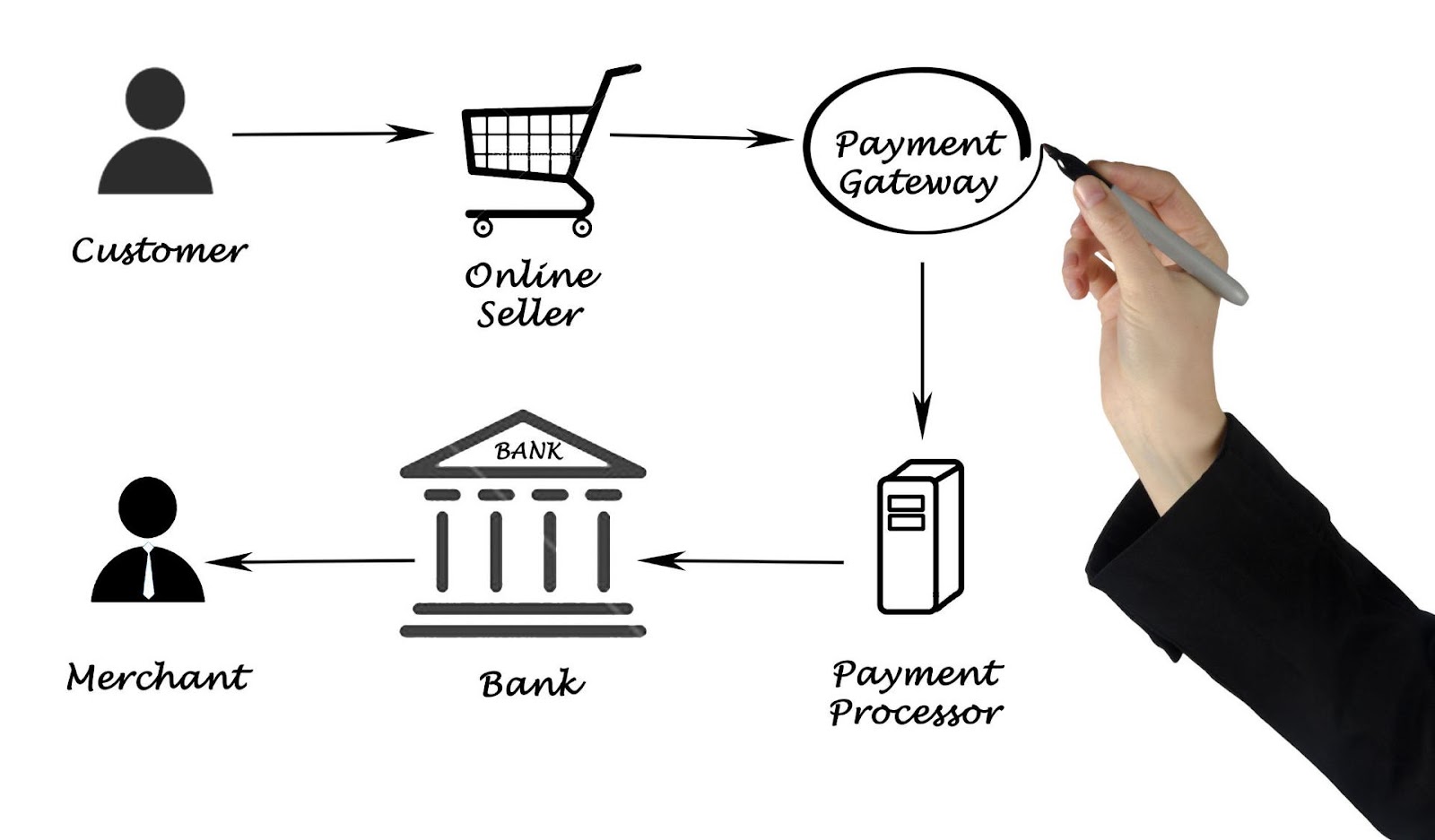

A payment gateway is a third-party purchase holder that uses a payment processor to transfer funds from a customer to the merchant through credit or debit cards.

As opposed to cash and checks, credit cards do not allow direct dealings with the bank for small merchants, forcing them to use payment gateways.

Payment gateways are used for almost every online transaction.

Popular payment gateways include PayPal, Venmo, Google Pay, and CashApp.

While these gateways are extremely popular and used by many, they limit businesses extremely.

First, to use any of these gateways, both parties must have a setup account with them, meaning if a customer does not have a PayPal account and a merchant only accepts PayPal, the merchant most likely just lost a customer.

Secondly, these gateways require the use of an outside device to follow through with their actions. All the gateways previously mentioned are on smart phone devices.

When dealing with older customers who may have a credit card but are not too tech savvy and live their life without personal gateways, the merchant is going to need a more versatile option that does not require a lot of effort on the customer’s end, making merchant to customer relations better anyway.

While the aforementioned gateways mentioned are by no means bad (and are even recommended as an alternative option to provide customers) there’s no question that your business needs to be able to handle basic card payments

Where Does the Money Go When Using a Gateway?

When a payment gateway is involved, there are a lot of stops along the way before a payment made by a customer reaches the merchant as money in their account.

The traveling process loses a few dollars along the way as well, leaving some users wondering where it went. Let’s take a look at a simple example.

The money begins in the hands of the customer. The customer finds a product they like on a website and decides to buy it. The website accepts card payments because they integrate with a payment gateway like Stripe.

When the customer submits valid card information, the payment gateway puts the money through a payment processor which distributes the funds accordingly. Most of the time, the gateway will take a percentage from the money to fund their own services and keep their gateway up and running. In this case, the rest of the money goes to the merchant’s bank where they can be accessed, withdrawn, or kept in the account by the merchant.

The key takeaway is that there are multiple entities involved in the transfer process, and fees are taken along the way.

Now that payment gateways and their processes are understood, the real discussion of which payment gateway to choose can begin.

Stripe Vs. Square: Costs

As mentioned before, the payment gateways must have a portion of the funds as their own to keep the gates open, so to speak.

Processing the payments is not such an easy job and requires effort, access, and trust, which is why every merchant does not do it themselves.

The different companies have tangible products that are sold at a value to go along with their use, and then a transaction fee on top of that.

Because the companies charge transaction fees for handling every payment, they do not make merchants pay a subscription fee.

However, these companies do offer extra paid-for services which merchants may or may not be interested in.

Stripe

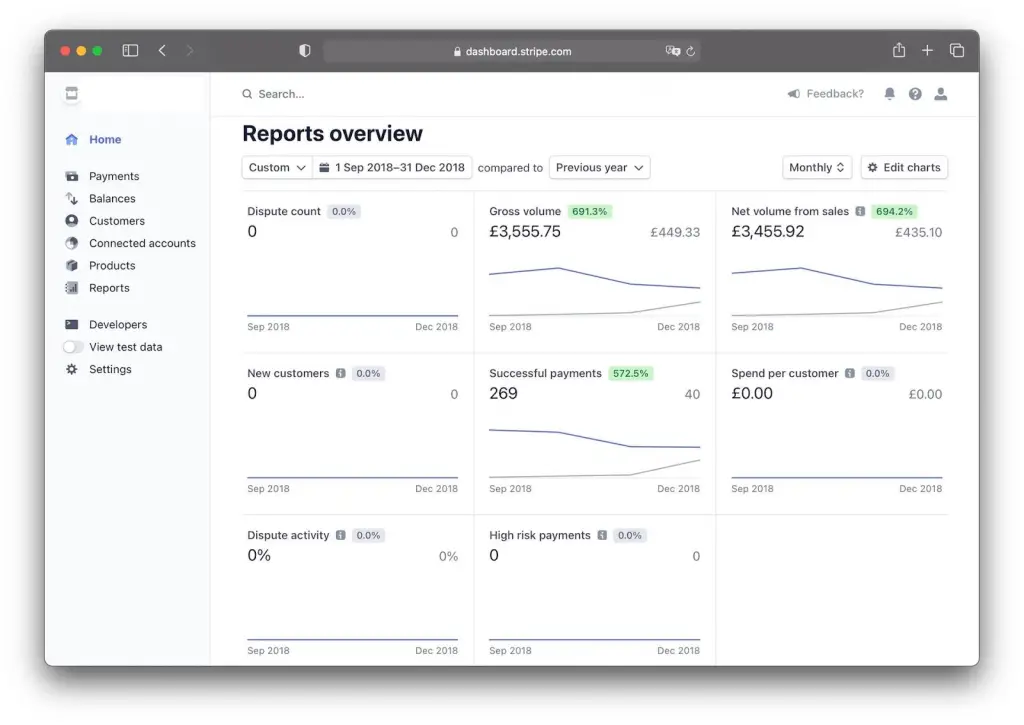

Stripe at a base level has a percentage fee upon successful payments but has add-ons that can be purchased through the company to boost a company or individual’s financial performances as well.

The basic integrated fee from using Stripe upon a successful payment is 2.9% of the payment value and an additional thirty cents ($0.30) for every payment.

This type of integrated payment would mean that if a customer bought your product for one hundred dollars ($100), that Stripe would keep three dollars and twenty cents of those funds ($3.20) – the 2.9% that equals two dollars and ninety cents ($2.90) plus the additional the thirty cents ($0.30).

On top of the basic integration fee, Stripe also has many optional extras to help your business. For example, chargeback protection costs an extra 0.4%, while intelligent fraud detection costs a few cents.

For those really looking to take off with Stripe, they have a one-time fee of five hundred dollars ($500) that helps turn your business into a legal and financially functioning startup.

Premium assistance from the company itself can cost a consumer around one thousand eight hundred dollars ($1,800) per month, unlocking a personal customer manager and financial customization options.

To pull the payment gateway into the physical world for contact payments with cards, the merchant would first decide between Stripe’s two different card terminals (one costing $59 and one $299), then pay a 2.7% + five cents ($0.05) fee for any terminal payment.

Square

Square follows the same integration fee tactic as Stripe but charges a slightly lower percentage charge on all transfers, charging 2.6% + ten cents ($0.10) instead of Stripe’s 2.9% + thirty cents ($0.30). This would mean that in a product bought for one hundred dollars ($100), Square would keep two dollars and seventy cents ($2.70) upon a successful payment.

Whereas Stripe’s optional extras were mostly focused on payment processing, Square’s optional extras are more directed at helping the merchant themselves run the business with things like an employee payroll feature, customer loyalty feature, and more.

These services run from a monthly payment instead of additional percentages or one-time fees. The costs range from five dollars ($5) per month up to forty-five dollars ($45) per month.

Square also has terminals and physical interfaces for in-person card purchases. Square offers five (5) different terminal types depending on one’s needs or the types of cards they expect to deal with.

These terminals range from the magStripe reader that inserts into a smartphone (first reader free, each additional reader for $10) all the way up to the Square Register ($800 dollars or $39 per month for 24 months). With many options, there will surely be a terminal that suits your company’s needs.

Verdict

The flat fee speaks for itself in cost, showing that over time, Square will cost less money than Stripe thanks to its slightly lower transfer fees.

For additional percentage fees, however, Stripe offers richer payment handling features which Square lacks. As you approach large transaction volumes, Stripe will make sure you’re covered with the things you need as you scale.

Square also offers its own selection of optional extras, but with things like employee management, email marketing and inventory management, it is clear that Square isn’t just about processing card payments.

If you’re a brick and mortar business, the terminal costs are another factor, as Stripe’s terminals are fairly limited with two options and both being expensive in comparison to Square’s free device.

Despite all these differences, it’s clear that cost shouldn’t be the deciding factor when choosing between the two. Let’s take a look at some other considerations.

Stripe Vs. Square: Setup

Both Stripe and Square do not require extra setup for basic use outside of plug and play type software. As soon as the program is integrated, it can be used with minimal configuration.

However, Stripe is known for having an excellent API that allows software developers to customize the gateway to really fit the business needs. Whether one is looking to run an individual business or scale it out among multiple people and levels, Stripe can do it, if known how.

Square on the other hand doesn’t offer much in terms of flexibility or potential customization, but is engineered for simplicity. The interface is said to be one of the must user friendly for a payment gateway and can be used by anyone, whether you’re a plumber that wants go cashless or run an online shop that accepts card payments.

Verdict

The setup on both platforms is easy in terms of getting started.

Stripe has versatility and complications, but Square has limits and simplicity.

This decision comes down to how far out you believe your business will stretch in the future.

If you are looking for large expansions, then Stripe is the name of the game, if not, Square is your go to if you want things easy on yourself.

Stripe Vs. Square: Accepted Payment Types

Both companies accept most major card providers internationally, however, Stripe seems to have a few more options even outside of cards.

Stripe

Stripe accepts the following cards/electronic wallets: Visa, MasterCard, Maestro, American Express, Discover, Japan Credit Bureau, UnionPay, Apple Pay, and Google Pay.

Stripe accepts recurring payments and large settlements made by ACH debit/credit and wire transfer.

Stripe also accepts a number of alternative local payment types: Bancontact, Ideal, Giropay, Przelewy24, SEPA Debit, and Sofort.

They previously also played with the idea of supporting cryptocurrency (Bitcoin) payments, but those plans were scrapped.

Square

Square accepts the following card companies: Visa, MasterCard, American Express, Discover, JCB, and UnionPay. Credit, Corporate, Debit, Prepaid, and Rewards cards bearing any of the aforementioned logos are accepted.

Square also advertises that their processor can accept Health Savings Account (HAS) and Flexible Spending Account (FSA) cards, making it great for licensed health care providers and pharmacies to use.

On top of this, Square supports Employment Developmental Department (EDD) cards, and are rumored to be working on supporting Electronic Benefits Transfer (EBT) cards.

Lastly, Square advertises that most Government and Military cards should be able to be accepted, but approval is not guaranteed as it may differ between each card user.

Verdict

Square specializes in physical payments, offering far more than Stripe in terms of special niche cards such as Military cards and Health Savings cards.

Stripe, on the other hand, offers extreme versatility in online payments, accepting many international cards, virtual wallet payments, and alternative online transaction payment methods.

If the business has a lot of basic, in person dealings, Square is easier. If the transactions are online, international, and planning to have a varied customer base, Stripe is the road to take.

And The Winner Is…

Both companies have their strengths and weaknesses but at the end of the day, the answer will depend on your business.

Business owners with a physical point of sale will likely want to go with Square. Square has always been about helping the neighborhood electrician or coffee shop bring their business into the 21st century.

However, for eCommerce, Stripe takes the cake thanks to its superior API and integrations into online stores, as well as enterprise features that make it excellent for businesses that are selling at scale.

Once again, both have their place, but it seems clear that online merchants should lean toward Stripe, and those looking to work in person should consider using Square. Good luck and happy selling!

Do You Really Have To Make The Choice?

In reality, many businesses will find themselves not having the luxury of choosing between the two.

For example, Shopify is the second largest CMS on the internet and powers the vast majority of boutiques or small shops operating online. ‘Shopify payments’ is actually provided by Stripe, and you won’t even have the option of using Square.

Likewise, if you create a Weebly online store, you’ll have to use Square as the payment gateway (Square owns Weebly!)

So while it’s interesting to compare the two service providers, make sure you know what options are available to your business before going further.